Excitement About Custom Private Equity Asset Managers

Wiki Article

Custom Private Equity Asset Managers Fundamentals Explained

(PE): spending in companies that are not publicly traded. About $11 (https://yoomark.com/content/custom-private-equity-management-group-completes-indepth-research-market-needs-we-create). There may be a couple of points you don't comprehend concerning the sector.

Companions at PE companies raise funds and take care of the cash to produce desirable returns for investors, commonly with an financial investment perspective of between four and seven years. Private equity firms have a variety of financial investment preferences. Some are strict investors or easy financiers wholly dependent on management to grow the company and generate returns.

Due to the fact that the very best gravitate toward the larger bargains, the middle market is a considerably underserved market. There are extra sellers than there are highly experienced and well-positioned finance professionals with considerable customer networks and resources to handle a deal. The returns of personal equity are typically seen after a few years.

What Does Custom Private Equity Asset Managers Mean?

Traveling below the radar of big multinational companies, a number of these little firms usually give higher-quality client service and/or specific niche services and products that are not being used by the big conglomerates (https://www.ted.com/profiles/45686886/about). Such upsides draw in the rate of interest of personal equity firms, as they possess the insights and smart to manipulate such opportunities and take the business to the next level

The majority of supervisors at profile firms are given equity and bonus settlement structures that reward them for striking their economic targets. Personal equity possibilities are typically out of reach for individuals that can not invest millions of bucks, however they shouldn't be.

There are regulations, such as restrictions on the aggregate amount of cash and on the number of non-accredited capitalists. The personal equity company draws in some of the finest and brightest in corporate you could try these out America, including leading performers from Fortune 500 business and elite management consulting companies. Law office can also be hiring premises for private equity works with, as accounting and lawful abilities are needed to full deals, and purchases are highly looked for after. https://forums.hostsearch.com/member.php?252921-cpequityamtx.

The Buzz on Custom Private Equity Asset Managers

An additional negative aspect is the lack of liquidity; when in a personal equity purchase, it is hard to obtain out of or offer. There is an absence of flexibility. Exclusive equity likewise includes high costs. With funds under management currently in the trillions, exclusive equity firms have actually become eye-catching financial investment cars for wealthy individuals and establishments.

Now that access to private equity is opening up to more individual investors, the untapped possibility is becoming a reality. We'll begin with the main debates for spending in private equity: How and why personal equity returns have actually historically been higher than various other properties on a number of degrees, Just how including exclusive equity in a profile impacts the risk-return profile, by aiding to diversify against market and intermittent threat, After that, we will certainly lay out some crucial factors to consider and dangers for exclusive equity investors.

When it comes to introducing a brand-new property right into a portfolio, the most fundamental factor to consider is the risk-return account of that property. Historically, personal equity has displayed returns comparable to that of Emerging Market Equities and higher than all various other conventional property courses. Its reasonably low volatility combined with its high returns produces an engaging risk-return profile.

Custom Private Equity Asset Managers Fundamentals Explained

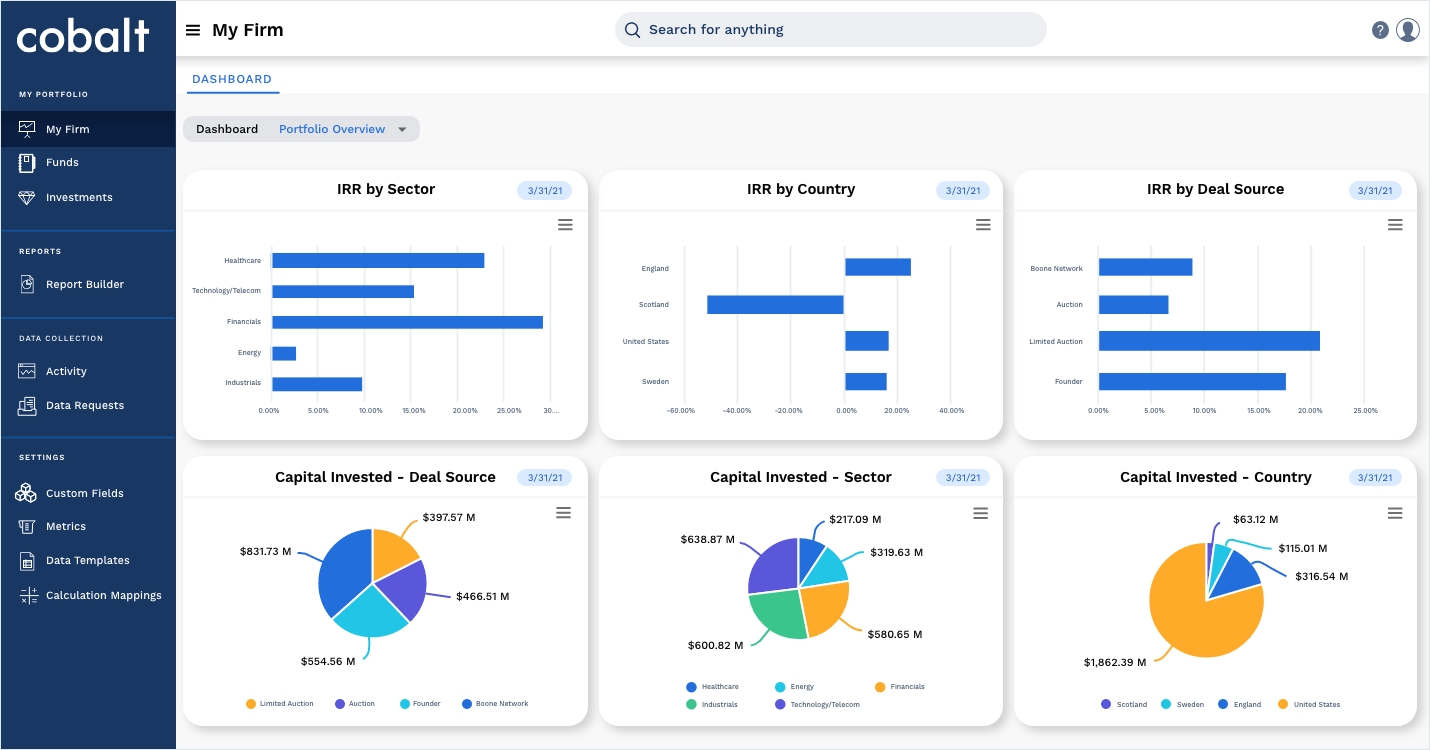

Personal equity fund quartiles have the widest variety of returns throughout all alternative property courses - as you can see below. Technique: Interior price of return (IRR) spreads out calculated for funds within classic years independently and after that balanced out. Mean IRR was determined bytaking the standard of the median IRR for funds within each vintage year.

The impact of adding exclusive equity right into a portfolio is - as always - reliant on the portfolio itself. A Pantheon research study from 2015 recommended that consisting of private equity in a portfolio of pure public equity can open 3.

On the other hand, the very best private equity companies have access to an even bigger pool of unknown chances that do not encounter the exact same scrutiny, along with the sources to do due persistance on them and recognize which deserve investing in (Syndicated Private Equity Opportunities). Spending at the first stage indicates greater threat, but for the business that do succeed, the fund advantages from higher returns

Some Of Custom Private Equity Asset Managers

Both public and private equity fund supervisors devote to investing a percentage of the fund but there remains a well-trodden problem with aligning rate of interests for public equity fund monitoring: the 'principal-agent trouble'. When a financier (the 'major') employs a public fund manager to take control of their funding (as an 'agent') they delegate control to the supervisor while preserving ownership of the properties.

In the situation of exclusive equity, the General Companion does not just make a management charge. Exclusive equity funds additionally minimize another kind of principal-agent issue.

A public equity capitalist ultimately wants one point - for the management to boost the stock cost and/or pay out rewards. The financier has little to no control over the decision. We revealed above the number of private equity strategies - particularly majority buyouts - take control of the running of the company, ensuring that the lasting worth of the firm precedes, raising the roi over the life of the fund.

Report this wiki page